E-Invoice

Invoice

Approval

Light unifies your global financial operations in one automated platform. Run AR, AP, bookkeeping, and financial reporting automatically across all your entities — without the chaos of multiple systems.

See the Light!

Book a demo

Bank

Revenue

Currency

Ledger

E-Invoice

Invoice

Approval

Light unifies your global financial operations in one automated platform. Run AR, AP, bookkeeping, and financial reporting automatically across all your entities — without the chaos of multiple systems.

See the Light!

Book a demo

Bank

Revenue

Currency

Ledger

Light unifies your global financial operations in one automated platform. Run AR, AP, bookkeeping, and financial reporting automatically across all your entities — without the chaos of multiple systems.

See the Light!

Book a demo

Light unifies your global financial operations in one automated platform. Run AR, AP, bookkeeping, and financial reporting automatically across all your entities — without the chaos of multiple systems.

See the Light!

Book a demo

Powering global businesses like

The first solution ever that makes non-finance employees excited about invoices and expenses

– Rasmus Vogt, Head of Finance at Famly

The first solution ever that makes non-finance employees excited about invoices and expenses

– Rasmus Vogt, Head of Finance at Famly

The first solution ever that makes non-finance employees excited about invoices and expenses

– Rasmus Vogt, Head of Finance at Famly

The first solution ever that makes non-finance employees excited about invoices and expenses

– Rasmus Vogt, Head of Finance at Famly

Sayonara, finance frankenstack 🧟♂️

Manage your spend

Pay globally

Capture revenue

Control & report

Employee & Vendor cards

Easily issue corporate cards that sync with your financial operations.

Spend limits

Set and adjust spending controls in real-time across teams and departments.

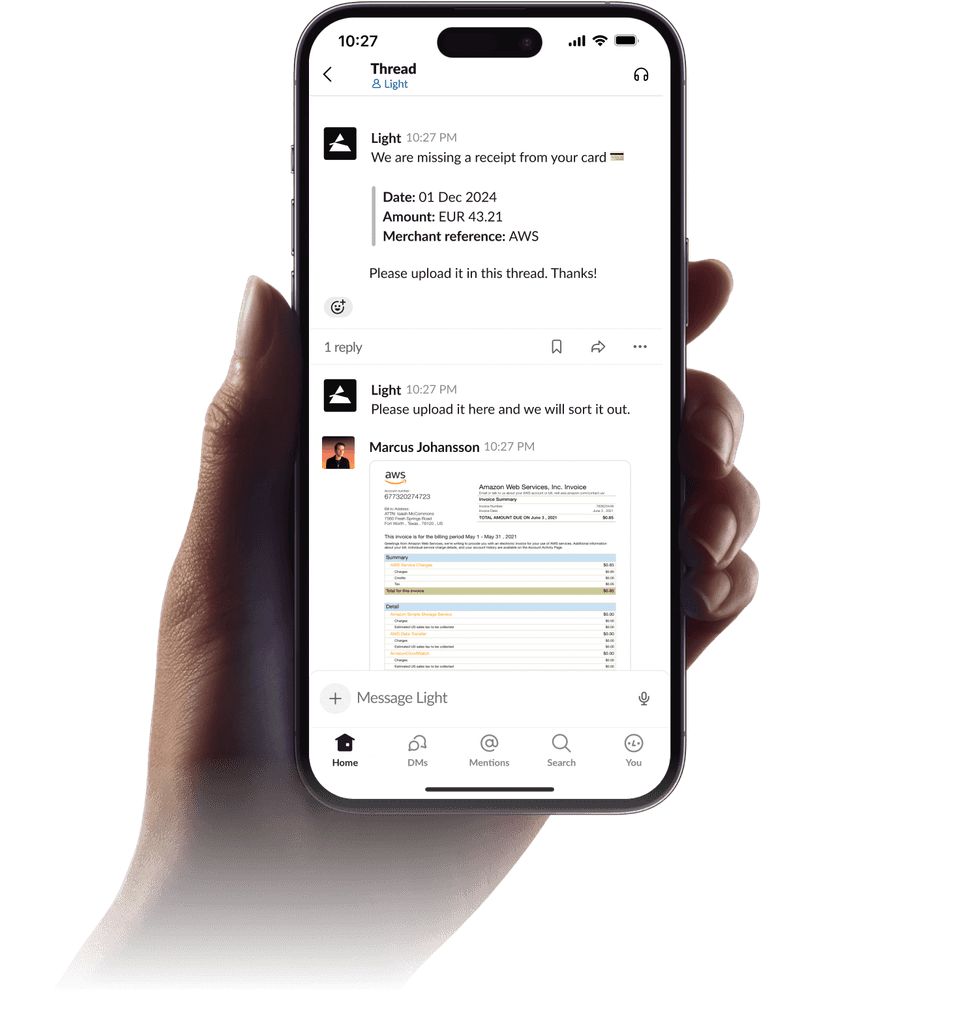

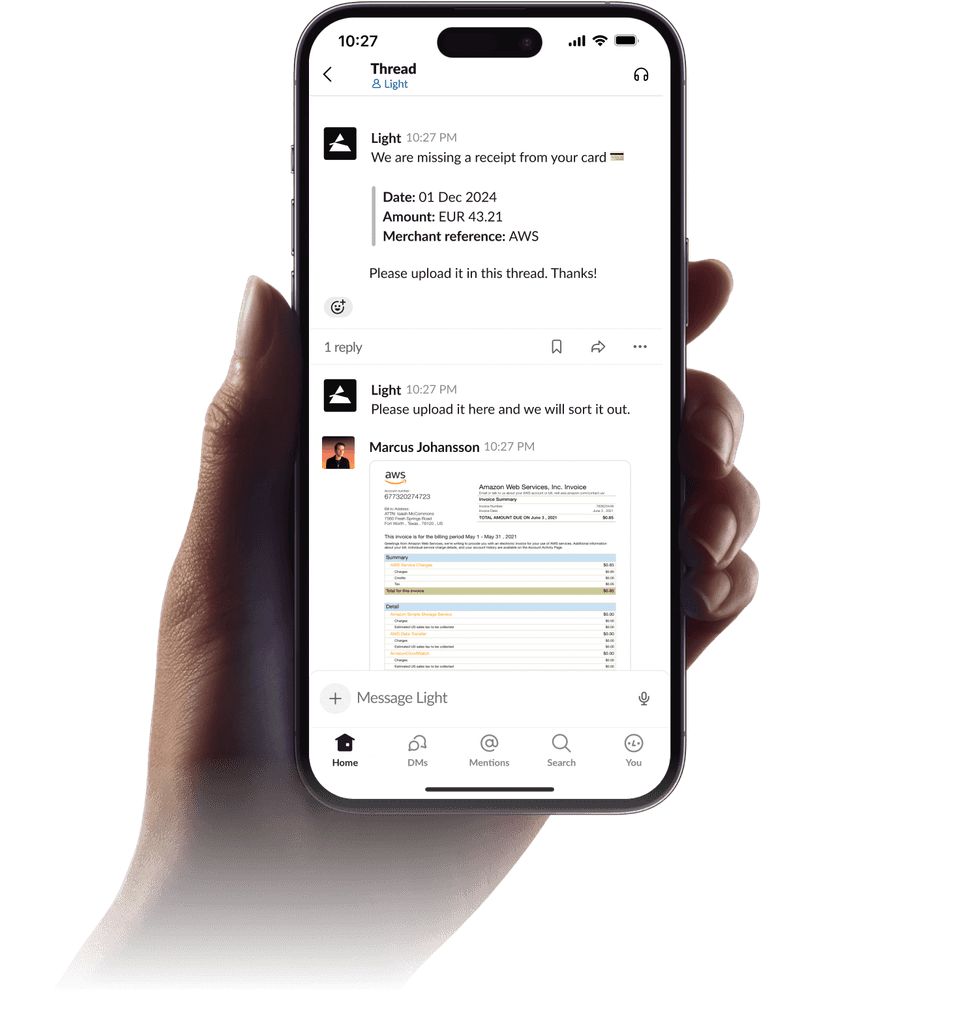

Upload receipts in Slack

Quickly share receipts in Slack for hassle-free approvals.

Sayonara, finance frankenstack 🧟♂️

Manage your spend

Pay globally

Capture revenue

Control & report

Employee & Vendor cards

Easily issue corporate cards that sync with your financial operations.

Spend limits

Set and adjust spending controls in real-time across teams and departments.

Upload receipts in Slack

Quickly share receipts in Slack for hassle-free approvals.

Sayonara, finance frankenstack 🧟♂️

Manage your spend

Pay globally

Capture revenue

Control & report

Employee & Vendor cards

Easily issue corporate cards that sync with your financial operations.

Spend limits

Set and adjust spending controls in real-time across teams and departments.

Upload receipts in Slack

Quickly share receipts in Slack for hassle-free approvals.

Sayonara, finance frankenstack 🧟♂️

Manage your spend

Pay globally

Capture revenue

Control & report

Employee & Vendor cards

Easily issue corporate cards that sync with your financial operations.

Spend limits

Set and adjust spending controls in real-time across teams and departments.

Upload receipts in Slack

Quickly share receipts in Slack for hassle-free approvals.

We partner with the world’s best

AI first accounting

AI first accounting

AI first accounting

Your 30 first days with Light

Your 30 first days with Light

Your 30 first days with Light

Onboarded in 4 weeks or free implementation

Onboarded in 4 weeks or free implementation

Onboarded in 4 weeks or free implementation

Foundation (Week 1-2)

Add global entities

Add global entities

Add global entities

Add global entities

Upload GL and bank records

Upload GL and bank records

Upload GL and bank records

Upload GL and bank records

Connect HRM and IM

Connect HRM and IM

Connect HRM and IM

Connect HRM and IM

Upload vendors and customers

Upload vendors and customers

Upload vendors and customers

Upload vendors and customers

Upload transactions

Upload transactions

Upload transactions

Upload transactions

Configuration (Week 2-3)

Configure approval workflows

Configure approval workflows

Configure approval workflows

Configure approval workflows

Configure revenue recognition rules

Configure revenue recognition rules

Configure revenue recognition rules

Configure revenue recognition rules

Setup invoicing processing

Setup invoicing processing

Setup invoicing processing

Setup invoicing processing

Setup tax codes per entity

Setup tax codes per entity

Setup tax codes per entity

Setup tax codes per entity

Connect to CRM

Connect to CRM

Connect to CRM

Connect to CRM

Setup custom properties

Setup custom properties

Setup custom properties

Setup custom properties

Setup workflows

Setup workflows

Setup workflows

Setup workflows

Add AI instructions

Add AI instructions

Add AI instructions

Add AI instructions

Test Slack integration

Test Slack integration

Test Slack integration

Test Slack integration

Validation & Launch (Week 3-4)

Test workflows

Test workflows

Run test consolidations

Run test consolidations

Run test consolidations

Run test consolidations

Train ops team

Train ops team

Train ops team

Train ops team

Wonder why you didn’t switch sooner 😎

Wonder why you didn’t switch sooner 😎

Wonder why you didn’t switch sooner 😎

Wonder why you didn’t switch sooner 😎

See the Light!

Book a demo

See the Light!

Book a demo

See the Light!

Book a demo

See the Light!

Book a demo

Trusted by leading companies

Trusted by leading companies

Trusted by leading companies

It's all because of you that we made this happen ❤️

It's all because of you that we made this happen ❤️

It's all because of you that we made this happen ❤️

“The first solution ever that makes non-finance employees excited about invoices and expenses”

“The first solution ever that makes non-finance employees excited about invoices and expenses”

“The first solution ever that makes non-finance employees excited about invoices and expenses”

“The first solution ever that makes non-finance employees excited about invoices and expenses”

Rasmus Vogt, Head of Finance at Famly

Alex, CFO

"Strict controls made easy for everyone. That's just how we like it."

Sarah, VP Accounting

"This is the best innovation for finance…EVER. Finance operations are so intuitive."

Mathias, Finance Director

"Multinational finance operations without the complexity."

Jeppe, VP Finance

"With Light, we're now running a lean, mean finance machine."

The next gen AI accounting platform

The next gen AI accounting platform

The next gen AI accounting platform

100X faster

Built on best-in class in-memory HTAP database for instant reporting and page load

Speed

Guarantee

Live in 4 weeks or

No implementation fee

Smooth approvals

Alan Gray, VP finance

Judy Alexandra, CFO

Rethinking

General

Ledger

Cleared

AI native

Message Light

Workbench

Context

Test prediction

Real-time reporting

Advanced auditing

Compare Light with

Netsuite

Netsuite

Database capacity

Scales to billions of transactions - without latency

Becomes slow at scale

Database security

Immutable ledger

Posted entries can be edited

Database design

HTAP

OLTP

Database responsiveness

<500ms for any transaction or report

Can take up to 100s to load a transaction/report

Accounts Receivable

Yes

No

Compare Light with

Netsuite

Netsuite

Database capacity

Scales to billions of transactions - without latency

Becomes slow at scale

Database security

Immutable ledger

Posted entries can be edited

Database design

HTAP

OLTP

Database responsiveness

<500ms for any transaction or report

Can take up to 100s to load a transaction/report

Accounts Receivable

Yes

No