Unify your financial data with Light

Experience the next generation smart financial platform

X faster

Built on best-in class in-memory HTAP database for instant reporting and page load

Slash 80% of manual finance tasks

Smooth approvals

Rethinking

Cleared

AI native

Workbench

Test prediction

Sales and tax

Total (gross) sales

12,000.56 EUR

Purchases subject to use tax

12,000.56 EUR

Total (add lines 1 and 2)

12,000.56 EUR

Less tax prepayments

Remaining tax due (subtract line 16 from line 15)

200,000.00 EUR

PENALTY: (multiply line 17 by 10 percent [0.10] if payment is made, or your tax

return is filed, after the due date shown above)

200,000.00 EUR

Box B - goods - are reported for "EU sales without VAT". The value of goods sold without VAT in ten other EU countries.

200,000.00 EUR

Box B - goods - are not reported for "EU sales without VAT".

The value of, for example, installation and assembly, remote sales and new means of transport for non-VAT-registered customers without VAT to other EU countries.

200,000.00 EUR

Section B - benefits. The value of certain service sales without VAT to other EU countries. Reported to "EU sales without VAT".

200,000.00 EUR

Section C. The value of other goods and services that are supplied without tax in this country, in other EU countries and in countries outside the EU, cf. section 52, subsection of the executive order. 10

200,000.00 EUR

State

California

Tax period

Oct 2023 - Oct 2023

VAT report

Output tax (VAT payable)

200,000.00 EUR

VAT on goods purchased abroad (both the EU and third countries

0 EUR

VAT on services purchased abroad with reverse charge obligation

12,000.56 EUR

Deductions

Additional Information

Category A - goods. The value without VAT of goods purchased in other EU countries (EU acquisitions)

200,000.00 EUR

Category A - services. The value without VAT of service purchases in other EU countries

200,000.00 EUR

Box B - goods - are reported for "EU sales without VAT". The value of goods sold without VAT in ten other EU countries.

200,000.00 EUR

Box B - goods - are not reported for "EU sales without VAT".

The value of, for example, installation and assembly, remote sales and new means of transport for non-VAT-registered customers without VAT to other EU countries.

200,000.00 EUR

Section B - benefits. The value of certain service sales without VAT to other EU countries. Reported to "EU sales without VAT".

200,000.00 EUR

Section C. The value of other goods and services that are supplied without tax in this country, in other EU countries and in countries outside the EU, cf. section 52, subsection of the executive order. 10

200,000.00 EUR

Entity

Acme ApS

Tax period

Oct 2023 - Oct 2023

Profit and Loss

Sep 2023, EUR

INCOME

Sales

4,141,511.00

TOTAL INCOME

4,141,511.00

COST OF GOODS SOLD

COGS

20,415.00

TOTAL COST OF GOODS SOLD

20,415.00

GROSS PROFIT

20,415.00

OPERATING EXPENSES

Bank charges fees

21,140.00

Business development

176,401.00

Advertising & marketing

132,415.00

Website & software

22,846.00

Total Business development

176,401.00 EUR

Insurance

1,120.00 EUR

Legal & professional Services

15,261.00 EUR

Office Supplies & software

25,251.00 EUR

Payroll Expenses

3,155,261.00 EUR

Contractors

155,437.00 EUR

Payroll Fees

1,626.00 EUR

Salaries & Wages

2,998,198.00 EUR

Total Payroll Expenses

3,155,261.00 EUR

Transaction services

117,225.00 EUR

TOTAL OPERATING EXPENSES

3,511,5591.00 EUR

NET OPERATED INCOME

84,336.00 EUR

Single source of truth for your global financial data. Craft reports with a touch, manage taxes and currencies effortlessly.

Light automatically cleans your data and creates consolidated or financial report with exceptional detail and accuracy.

Our AI-native tax engines are designed to make reporting effortless. Seamlessly handle VAT, sales-tax and use-tax

Advanced capabilities to handle multiple currencies. From real-time conversion to automated valuation adjustments.

Natively built for multi-entity businesses, ensuring you can seamlessly run statutory reporting and view consolidated reports.

Our in-memory database design handles billions of transactions and runs reports in milliseconds, across all of your entities.

Take down your month-end closing process from weeks to a day. Make your flash report your only report.

AI native

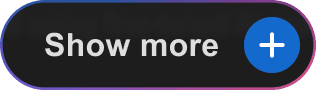

Let Light AI streamline finance and deliver effortless insights. Experience how it self-tunes to your company and your needs.

Whether the the document French, Greek or Swedish, all line items are captured and categorised using fine-tuned AI models.

Leverage the Assistant for answers, purchases, and reimbursements directly in Slack or Teams.

As more transactions are processed, the AI tunes to your company and your needs.

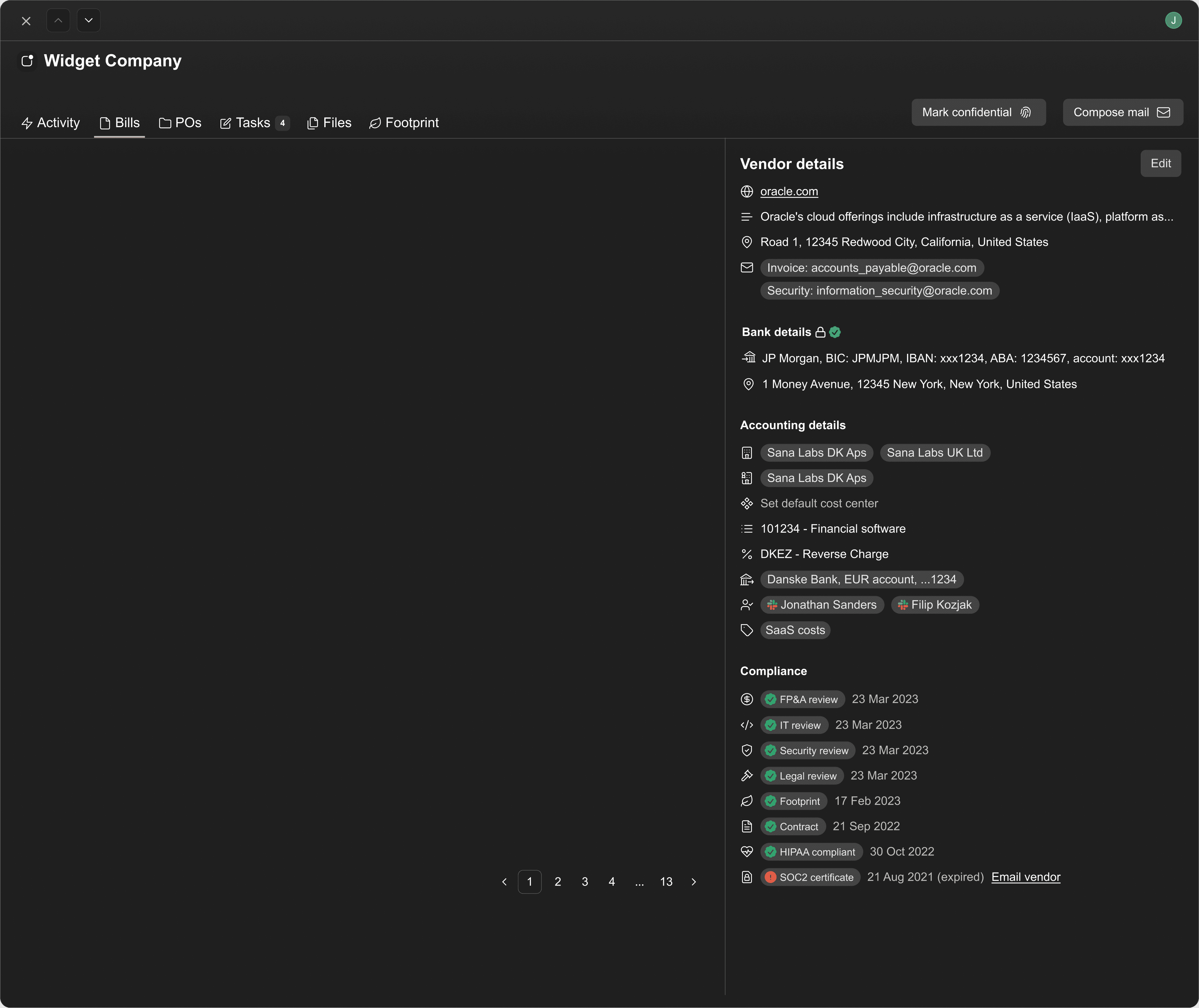

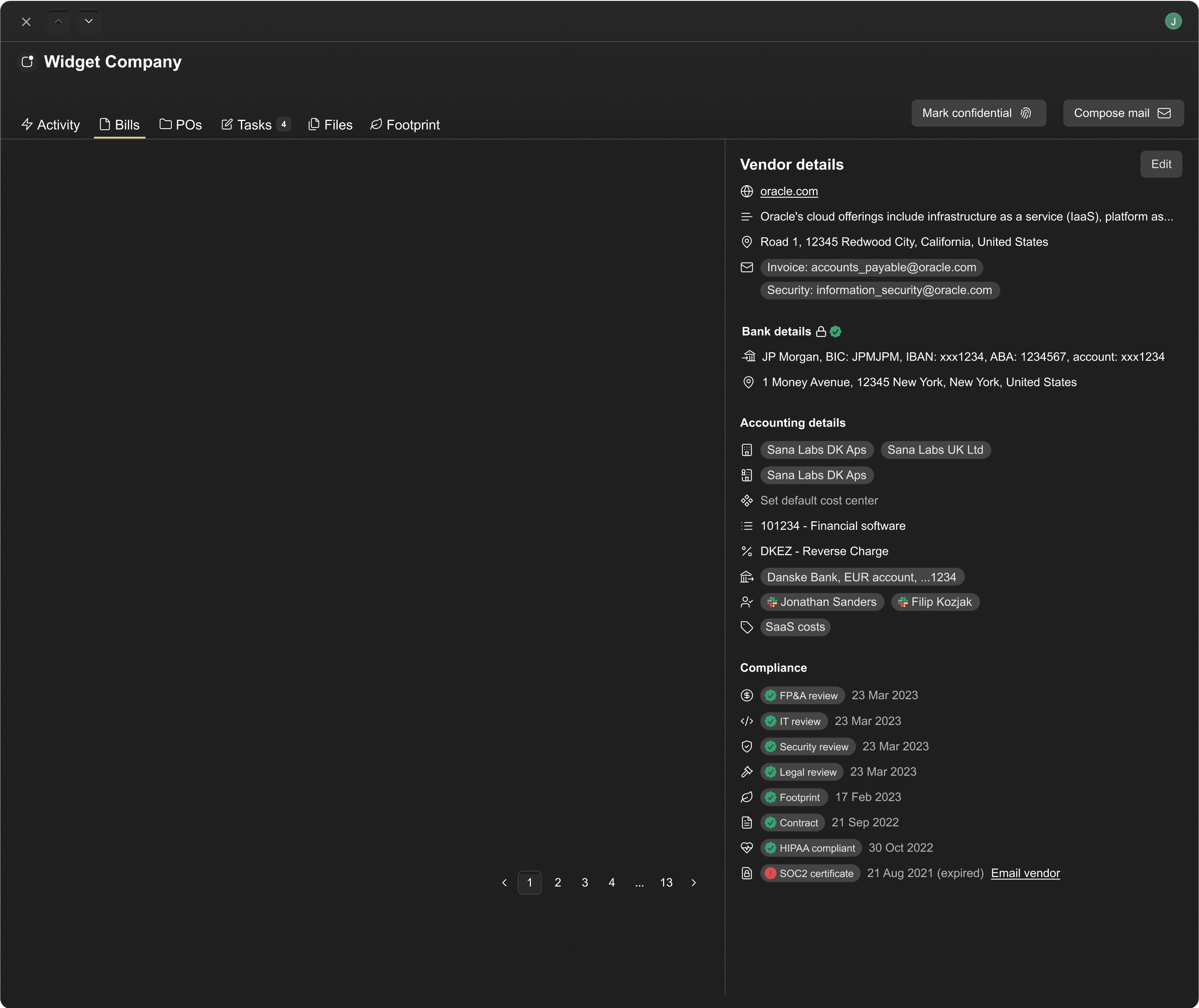

Advanced auditing

Track every interaction, every document, every detail all in one place. Lock in requirement on approvals or tailor your own flows.

Lock in requirement on approvals, set number, limits or specify approvers - all within Light. Stop fraud before it starts.

Light's workflow builder lets you customize approvals. Tailor who gets involved, at what stage, and for what amount.

Light's comprehensive audit log captures every interaction, document, and detail. Never lose track of anything again.

Integration

Integrates with Slack, Teams, HR & CRM systems, as well as 500+ bank connections for simple onboarding and breezy management.

Light seamlessly integrates with Slack and teams, leveraging a familiar interface to get things done.

Connect Light with your CRM and HR systems. Onboard new employees and add customers in seconds.

With over 500 bank connections, you can easily check your cash flow and execute payments with ease and efficiency.

Xero and Quickbooks

Netsuite and Microsoft Dynamics

Database capacity

More than billions of transactions

Doesn’t handle scale

Becomes slow at scale

Database security

Append-only ledger

Posted entries can be edited

Posted entries can be edited

Database design

HTAP

OLTP

OLTP

Database responsiveness

<500ms for any transaction or report

Can take up to 100s to load a transaction/report

Can take up to 100s to load a transaction/report

Accounts Receivable

Yes

No

No

Accounts Payable

Yes

No

No

Reimbursements

Yes

No

No

Spend management

Yes

No

No

Budget and forecasts

Yes

No

No

Consolidated reporting

Yes

No

Complicated

Reconciliation

Fully automated and customisable

Partial automated

Manual

Purchase Orders

Yes, incl. blanket POs and seamless invoice matching

No

Complicated

AI

Intelligent pre-accounting and insights

No

No

Taxes

Partial and reverse charge VAT. Use and sales-tax

Imprecise partial VAT handling

Imprecise partial VAT handling

Implementation in 16 weeks

Yes

Yes

No